SOLAR IS AFFORDABLE FOR EVERYONE…

It’s time to go Solar with Excel Solar!

The professionals at Excel Solar have been serving Brevard and East Central Florida since the early 80’s. In that time, they have seen the solar industry evolve into this country’s most affordable source for clean, reliable, everlasting energy. The newest generation of solar electric (PV) and solar thermal technology has put energy independence within the reach of all homeowners. With 100% financing, 30% tax credits and FREE no pressure estimates, own the power with Excel Solar. Habla español! More

Interested in powering your home with SOLAR ENERGY?

FREE SAVINGS EVALUATION

Call us or complete the form below for a free comprehensive energy savings evaluation:

Rooftops, Hurricanes, and Solar Panels:

EXPERT INSTALLATION IS CRITICAL.

Across more than four decades, we have seen all kinds of roofs and installed all kinds of solar systems. We know what panels and systems will hold up to the rigors of Florida’s storms and climate. Our friendly and professional installers know all of the codes, installation techniques, and best practices to securely and aesthetically fasten every system we sell on any roof type or configuration. More

Over many years, we have installed systems on thousands of rooftops:

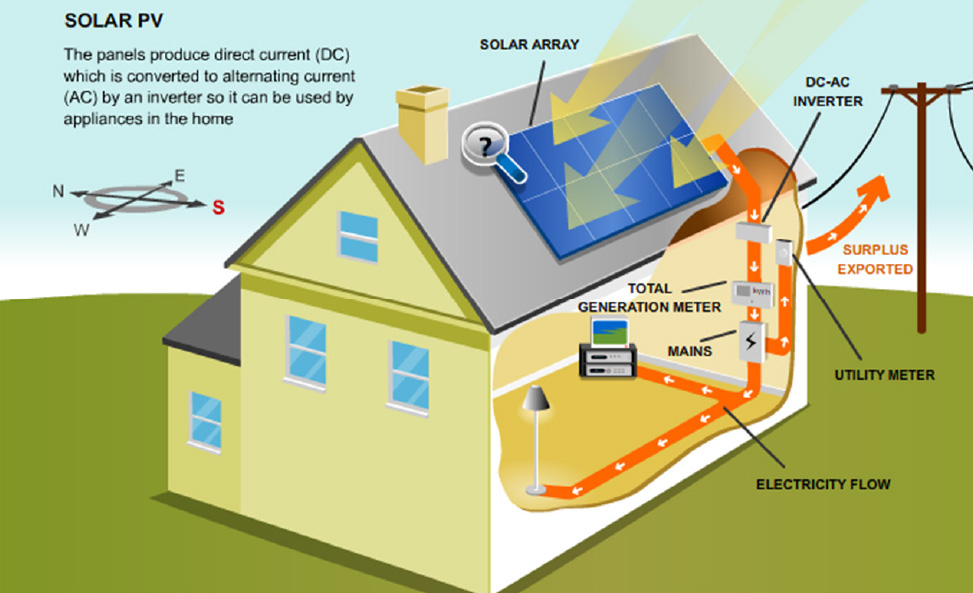

Declare your energy independence with a Photovoltaic (PV) Solar Electric system.

Sell your excess power to FPL.

You can create your own electricity and sell what you don’t use to Florida Power & Light. Call us for details on our complete home solar solutions as well as energy storage solutions. More

Here is what our growing family of satisfied customers have to say:

CLICK HERE to read more.

“I am so glad I went with Excel Solar. They are such a professional company and made this experience a positive one. Our solar pool heater works really well and we are enjoying our pool all the time. I will definitely recommend them!”

Annette B. Palm Bay, FL

“Everything is as good as it possibly could be. Our pool is 88 degrees in November! Excel delivered on every single promise. We will happily recommend Excel Solar to others and you are more than welcome to use our name for references.”

Herb and Becky T. Vero Beach, FL

“What a fantastic experience working with Excel Solar. I will recommend them to all my family, friends and neighbors. It was refreshing that whenever I called the office, Kelly answered the phone. Russ was so honest and he and his crew did everything they promised. I am using my pool every day now thanks to Excel.”

Evelyn M. Palm Bay, FL